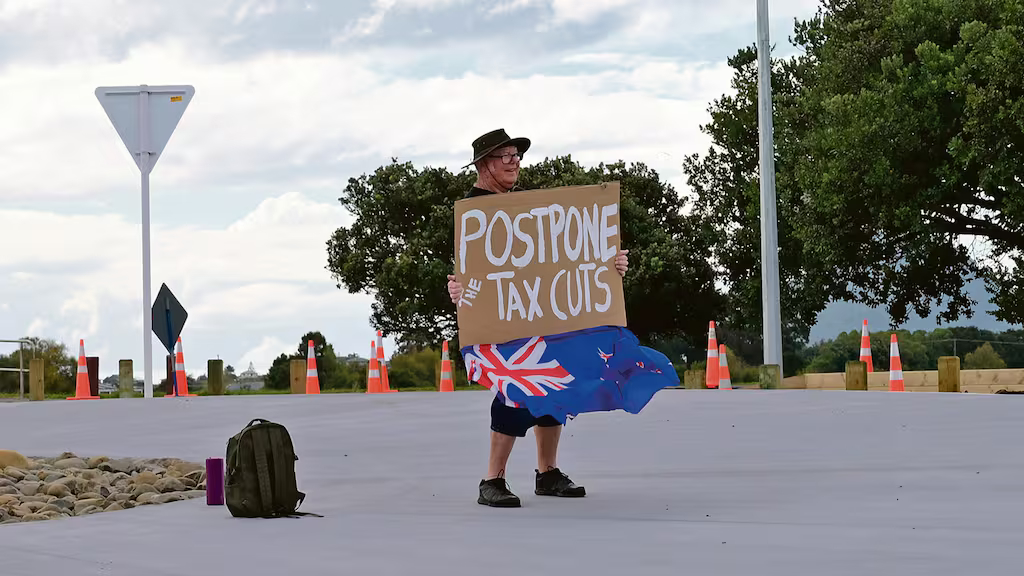

In the leadup to National’s first budget I protested that the planned tax cuts were unaffordable and stood on a roundabout in my home town and let everyone know I was concerned.

The support was just incredible.

Soon I was joined by more and more people and we made a big noise predicting that everything that has happened was the only outcome from such disastrous policy.

![]() The Postpone The Tax Cuts Facebook Page remains a valuable historical resource recording how many people predicted the disaster that is this National led coalition government would be.

The Postpone The Tax Cuts Facebook Page remains a valuable historical resource recording how many people predicted the disaster that is this National led coalition government would be.

Dave Stewart

Postpone The Tax Cuts The Beacon, April 26, 2024

OPINION: POSTPONE THE TAX CUTS

As the new coalition Government’s first budget is about to be released it’s a good time to reflect on the advice, and the politics and ideology, around the proposed tax cuts that are the cornerstone of ACT and National’s policy.

The way National’s Tax Cuts work is the less you earn, the worse off you are. Anyone earning below $45,000 a year would receive only $2 a week extra from National’s tax relief package, a household couple without children earning a total of $120,000 a year, would each get back $25 a week, as would a single full time worker on $60,000 per annum.

A minimum wage worker would get $10 a week, and a superannuitant couple would each get about $6.50 a week, or roughly one third of the price of a block of Mainland Tasty.

When you get to the PM’s pay scale you get $18,000 tax relief.

Now we need to look at what this lolly scramble will cost you.

In the lead up to the 2023 election a lot of noise was made about the country’s finances and wasteful spending.

We were told that the previous Government had ‘wrecked’ the economy by the political leaders vying for our votes.

The Wall Street Journal disagreed and rated Aotearoa as the best country in the world for doing business in 2022. Second was Singapore.

We were one of the very few countries to receive a credit rating upgrade during covid.

The IMF measures gross debt as a percentage of GDP, we’re 6 per cent better than Australia and the UK, USA and Canada has twice what ours is. Japan has 6 times our debt.

We do have debt, we borrowed billions to support businesses through covid by making sure when we came out of it the workforce was intact.

No one knows what kind of debt we would have had with a worse covid response by a different Government, just that we could add 20,000 lives to that cost.

Compared to other countries we were doing pretty good debt wise.

If we learned nothing else during covid, it was that we need a robust health system and how much we rely on minimum wage workers for essentials.

And of course, we adjust the minimum wage at the end of the inflation cycle and the new coalition chose to make the minimum wage workers take the big hit by reducing the increase in the minimum wage to just 2% when the Ministry of Business, Innovation and Employment recommended in its review that the wage be increased by 4%

This 4% option was estimated to produce no restraints on employment in 2024, therefore meeting the objective relating to job losses. It also roughly protected the real current value of the minimum wage as it approximately matched Treasury’s and Reserve Banks’s forecast CPI inflation rate for the March 2024 quarter (4.3 percent).

The new coalition Government effectively gave minimum wage workers a pay cut to help pay for their tax cuts to wealthier New Zealanders.

The other target for the political opportunists out there was ‘wasteful spending’ and it turns out that this is the wages and salaries of hardworking public servants.

Our educators and health teams, our border security and biodiversity workers. The Police. The Department of Internal Affairs loses workers from teams dealing with child exploitation, money laundering and counter terrorism.

All must go to help save money for the tax cuts.

We’re told the public service is bloated.

But the reality, as opposed to the political spin, is worth noting.

In 2010 the whole of the public sector made up 19.7% of NZ’s total workforce. In 2023 it made up 18.8%.

Claims there has been an explosion in the public sector are pure spin by people hoping we don’t examine their words too closely.

The job cuts are purely political in nature.

They will 1. Reduce the role of Government, 2. Open up profitable opportunities for the private sector to do the work and 3. Abolish outreach programmes targeted at Māori communities.

The key to the job cuts is to help finance the tax cuts to the wealthy and to bring down wage levels. According to the latest data from Trade Me Jobs shows the cuts are already having an impact in Wellington’s job market, with the average salary down 3.3 per cent on the previous quarter.

Other people losing their jobs to fund tax cuts to the wealthy will impact on all of us.

These cuts and the tax handouts to the landlords in the billions of dollars, significantly reduce Government revenue at the same time as the need for public service provision is increasing.

The worst part of all of this is the $15 billion of borrowing forecast to cover the costs in this new budget.

At a time when we are looking to our Prime Minister to come good on his business skills and run the country with due business diligence to our ability to afford the ‘nice to have’ things like huge tax cuts, we are sending future generations into extreme debt to give taxpayer funded welfare handouts to landlords and higher income earners.

The pure politics of this pursuit of feeding the greedy has the real ability to completely wreck our economy and leave Aotearoa in a state that we will barely recognise.

The proposed tax cuts will increase inflation, will extend the recession and will do nothing to address the cost-of-living crisis.

This isn’t a right wing versus left wing argument.

This is simply a right versus wrong argument.

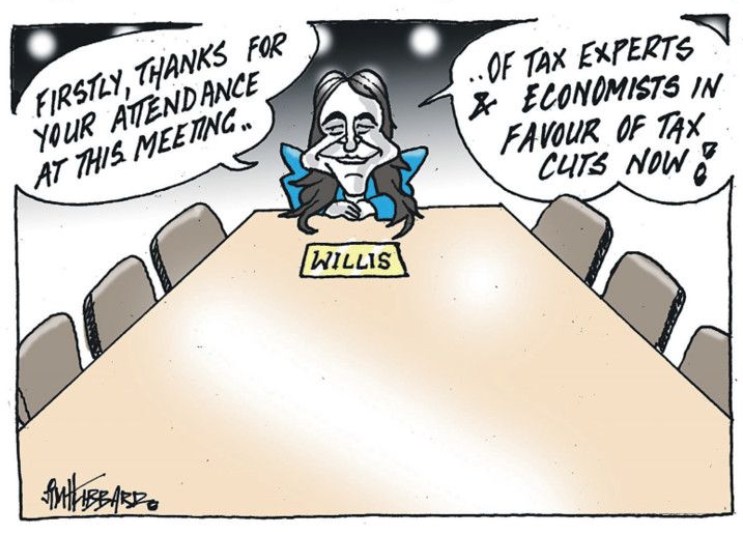

Indeed, right wing commentators such as Matthew Hooton and Richard Prebble have talked of the nonsense arguments put forward by the new coalition Government to defend the tax cuts and have advised to postpone the tax cuts.

Major banks and every economist across the board have said this wasteful spending on tax cuts is ill-advised at this time.

There is no justification for these tax cuts, other than ‘I’m entitled’. However, you won’t be entitled to recover what these tax cuts will cost you.

The new coalition Government must postpone the tax cuts until the country can afford to pay for them.

Dave Stewart is a retired company director and a regular contributor to The Beacon. He has been running a high-profile community-based campaign of public demonstrations to Postpone the Tax Cuts around Whakatane.

![]()