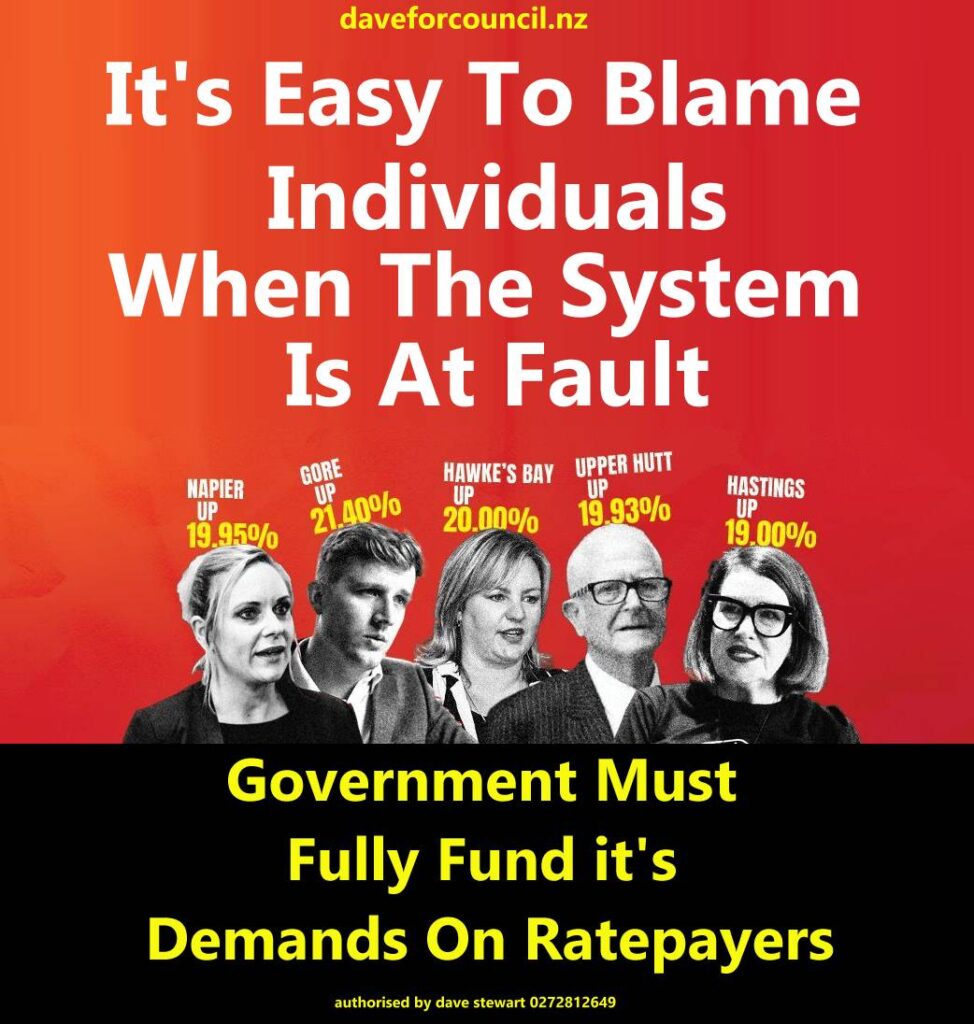

Homeowners are facing average rates rises of 15% according to data in draft long-term plans across 48 councils, averaging at about $8 more per week* per household.

LGNZ commissioned a report by one of the country’s leading economists, Brad Olsen, which starkly illustrates the cost pressures councils are under. It also states that between 2002-2022, the average rates rise was only 5.7% per year, and rates rises averaged 9.8% in 2023.

“Councils are acutely aware they need to balance the need for investment with affordable increases but the pressure has reached tipping point,” says LGNZ’s Vice-President Mayor Campbell Barry.

New Zealand’s rising rates are primarily due to increasing costs for local councils, including infrastructure upgrades, population growth, and inflation, leading to higher rates to fund essential services and meet community needs.

Here’s a more detailed breakdown:

1. Increased Costs for Local Councils:

Infrastructure:

Councils face rising costs for maintaining and upgrading existing infrastructure (roads, water, etc.) and building new infrastructure to support growing populations.

Population Growth:

Growing populations, especially in urban areas, require more services and infrastructure, putting pressure on council budgets.

Inflation:

General price increases (inflation) affect the cost of everything councils purchase, from materials to services.

2. Specific Factors Contributing to Rate Increases:

Rising Construction Costs:

The cost of building and construction materials has increased significantly, impacting infrastructure projects.

Insurance Costs:

Insurance premiums for council assets and services have also risen, contributing to higher expenses.

Debt Servicing:

Councils may need to borrow money for infrastructure projects, and rising interest rates increase the cost of servicing that debt.

Climate Change:

Adapting to climate change and addressing natural hazards (e.g., coastal erosion, extreme weather events) requires significant investment.

Meeting Increased Demand:

Councils are facing increased demand for services due to population growth, tourism, and other factors.

Shifting Demands:

Some communities have changing needs (e.g., new housing developments, increased demand for certain services) that require new or upgraded infrastructure and services.

3. The Broader Economic Context:

High Inflation:

High inflation, both globally and in New Zealand, has a significant impact on council budgets, as the cost of everything they purchase increases.

Reserve Bank’s Role:

The Reserve Bank of New Zealand may raise interest rates to curb inflation, which can also increase the cost of borrowing for councils.

4. Potential Solutions:

Alternative Funding Models:

Some propose exploring alternative funding sources for councils, such as levies on tourists or developers, or sharing GST revenue from new builds.

Government Support:

Some argue that central government needs to provide more financial support to local councils or review the funding model for local government.

Further reading:

Drivers behind rates rises across the country laid bare – LGNZ